All Operators

These DOT compliance basics apply to most limousine operators. Those providing airport transfers are generally interstate operators and require a DOT Number, MC Number, and at least $1.5m in insurance.

Interstate Operations

FMCSA has interpreted pre-arranged transportation operating at the airport, seaport, train station, etc, to be a continuation of the original trip (multi-modal transportation). This means that unless the flight originated in your state and you can show that no passengers had connections from other states, airport transportation is generally considered interstate.

Here is a good link on it: https://www.fmcsa.dot.gov/…/multi-modal-passenger…

FMCSA Jurisdiction

The applicable regulations are related to FMCSA Jurisdiction and financial responsibility limits. Anyone operating in interstate commerce who does not meet an exemption from 49 USC 13506(a) or 49 CFR 372, is subject to FMCSA regulations under 49 USC 13501 (Jurisdiction). These regulations are not limited to specific vehicles types or sizes.

This means that operators using only sedans and SUVs are not subject to many of the safety regulations but must have a USDOT, MC number, appropriate financial responsibility, and BOC3 filing. The current fine for operating without appropriate authority is about $26,000.

Insurance Limits

Insurance limits can be found under 387.33T. Basically 1.5m if 15 or fewer passengers, $5m if above, both counts include the driver seat.

Federal Filings

Filing has a few steps:

Apply Here for DOT and MC # – $300

Submit Insurance

Obtain a BOC-3 Agent (Google, several available, usually a one time fee of $25-30)

File your UCR Here

Operators with Vehicles Seating 9+

In addition to the above, FMCSA Safety Regulations take effect for these operators.

This includes:

Vehicle Markings

Vehicle Inspections

Driver Qualification

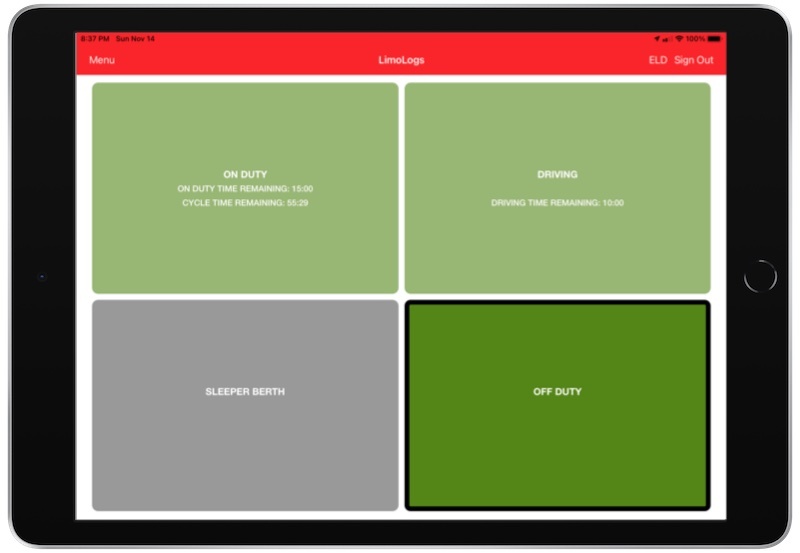

Hours of Service

Operators with Vehicles Seating 16+

For most states, this is where CDL Licensing becomes required and with it DOT drug testing. The most common issue we see is CDLs and Non-CDLs in the same pool. CDLs must be kept separate from Non-CDLs.