IFTA Audit Preparation with Real Audit Experience

Complete IFTA audit preparation with documentation review, variance analysis, and expert representation through the entire process. Our IFTA audit preparation expertise and ELD knowledge ensures GPS data meets audit requirements.

How LBC Fleet Stands Apart

- Real audit experience - We've supported over 3,000 DOT and IFTA audits with documented 99.8% satisfactory outcomes in our IFTA audit preparation services

- Expert representation - Our team attends opening conferences, responds to auditor requests, and advocates for your interests

- ELD expertise advantage - As an ELD company, we understand GPS data requirements and ensure your exports meet P540 audit standards

- Proactive preparation - We identify and resolve compliance gaps before auditors arrive, not after they find issues

- Complete documentation review - Every GPS point, fuel receipt, and mileage calculation verified against IFTA standards

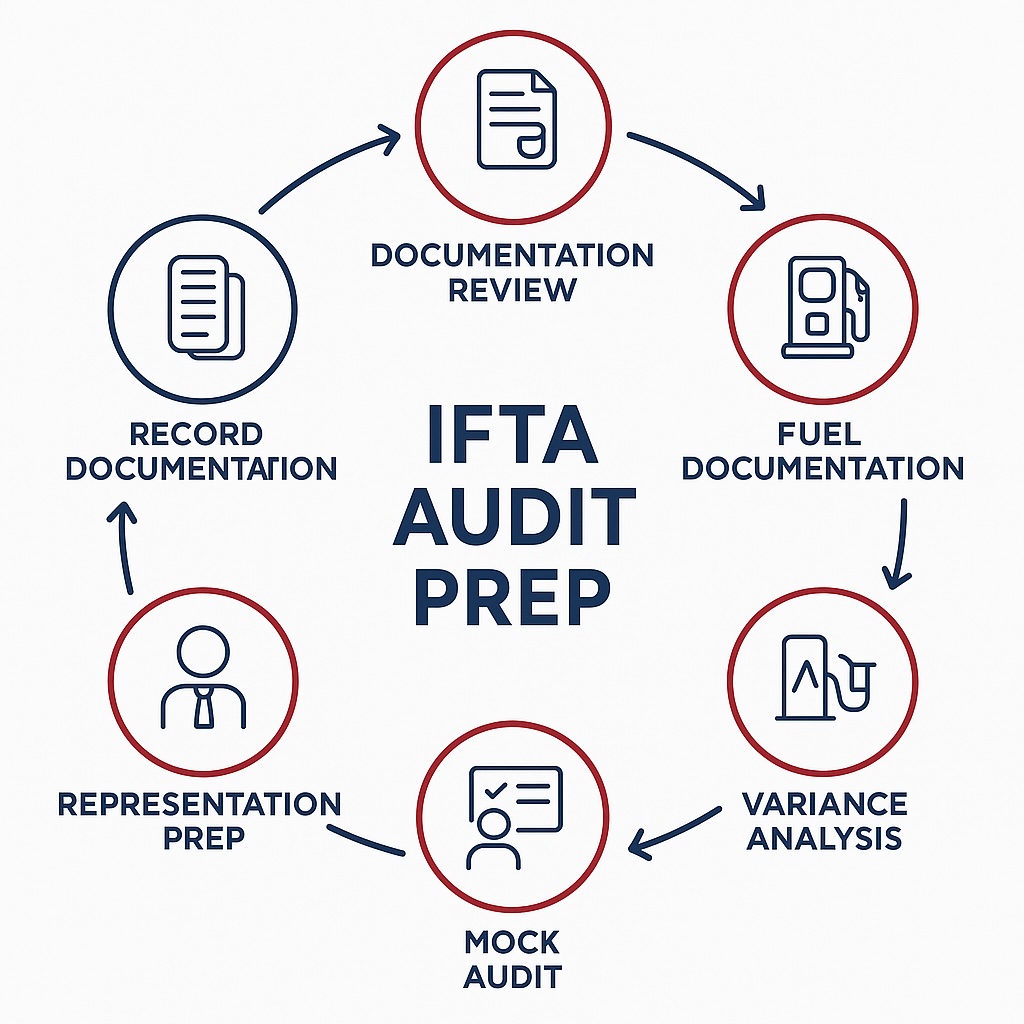

How to Prepare for an IFTA Audit

- Documentation Review - Verify GPS/ELD data meets the 10-minute requirement with proper lat-long coordinates and ECM readings

- Record Reconciliation - Align quarterly returns with monthly summaries and trip-level records

- Fuel Documentation - Compile retail receipts and bulk fuel logs that satisfy P550 requirements

- Variance Analysis - Identify and explain any MPG fluctuations or unusual patterns

- Mock Audit - Run a practice audit with sampling and projection to surface risks early

- Representation Prep - Prepare responses to common auditor questions and objections

Learn more about IFTA compliance: Visit our complete IFTA filing and compliance guide for quarterly reporting requirements.

Why Choose LBC Fleet for IFTA Audit Preparation

Proven IFTA Audit Preparation Track Record

With over 3,000 audits supported and a 99.8% satisfactory outcome rate, we know exactly what auditors look for and how to prepare your records to pass inspection.

Complete IFTA Compliance Knowledge

Our team understands IFTA Procedures P540 (distance records) and P550 (fuel records) inside and out. Our ELD experience helps us ensure your GPS data, fuel receipts, and bulk logs meet exact regulatory requirements.

Expert Representation Throughout the Process

We attend opening conferences, respond to auditor information requests, and advocate for your position throughout the audit process. You're not facing this alone.

IFTA Audit Resources and Official References

LBC Fleet's Comprehensive Authority

Complete reference covering audit triggers, record requirements, GPS data formats, penalties, interest calculations, and preparation checklists. Includes direct links to IFTA procedures and state guidance.

Complete IFTA Compliance Guide

Comprehensive guide to IFTA filing requirements, quarterly reporting, and compliance best practices.

Federal Authority Sources

- Federal Motor Carrier Safety Administration - Primary regulator

- IFTA Procedures Manual (2024) - P510, P540, P550 requirements

- IFTA Articles of Agreement (2024) - Penalties and assessments

- IFTA Audit Manual (2022) - Selection and process

- Current IFTA Interest Rates - Updated annually

- 49 CFR Parts 300-399 - Motor carrier regulations

State Authority References

- California IFTA Guide (Pub 50)

- Colorado Penalties Reference

- Florida IFTA Information

- Iowa Recordkeeping Requirements

- Texas IFTA Requirements

- Oregon Fuel Tax Information

Professional Standards

- DOT Safety Mission - Federal safety priorities

- FMCSA Safety Management System - CSA scoring

- GAO Motor Carrier Safety Report - Congressional oversight

IFTA Audit Frequently Asked Questions

How often do IFTA audits happen?

Every base jurisdiction must complete audits averaging 3% of IFTA accounts annually, with set portions of low-distance and high-distance accounts. Any licensee may be selected.

How much notice will I get before an audit?

Auditors typically contact you about 30 days before the audit to outline the period and records they will review.

What records must I keep to pass an IFTA audit?

Keep distance and fuel records that meet IFTA Procedures P540 and P550, including GPS/ELD data at least every 10 minutes when the engine is on, plus retail receipts or accepted digital copies and bulk fuel logs.

How long must I retain IFTA records?

Retain all IFTA distance and fuel records for four years from the return due date or filing date, whichever is later.

What happens if my records are inadequate?

The base jurisdiction must apply an inadequate-records assessment. This can set fleet MPG to 4.00 or reduce reported MPG by 20%, and may disallow tax-paid credits without proper documentation.

What penalties apply for late filing or payment?

The IFTA Articles set a $50 or 10% penalty, whichever is greater, with interest charged monthly at an annually set IFTA rate. Jurisdictions publish the rate each year.

Professional IFTA Audit Preparation - Be Ready Before the Letter Arrives

We build a clean audit package with distance reconciled, fuel documented, and summaries aligned to returns. Ready for questions and sampling with expert representation throughout.

Questions? Call (480) 779-4342 or email info@lbcfleet.com